Advantages to Investors

Diamonds are especially acknowledged as movable and tangible assets because they carry some beneficial advantages for every human. It is considered to be a tangible asset as an asset that has a finite monetary value and usually a physical form. Tangible assets can typically always be transacted for some monetary value through the liquidity of different markets will vary. Tangible assets are the opposite of intangible assets which have a theorized value rather than a transactional exchange value.

Some of the major benefits for investors include:

- Secure Protection against inflation, market collapse, currency reform

- Anonymity (no registration required)

- Approved Bankruptcy proof

- Worldwide convertibility, meaning that the diamonds are – together with gold – the only internationally accepted alternative currency which keeps the same value all over the world

- No taxes on value gains (= tax-free betterment)

- Hardly any maintenance costs

- Represents the grandeur and luxury of a person and amplifies the look.

- Prices are independent of government laws and hence diamonds better retain their values, even during the recession

- Robust price-performance – historically diamonds have recovered well from price and economic slumps.

- Diamonds are a symbol of security and assured investments

- Strong supply & great demand

- The cases with diamonds are precise because of their durable/unbreakable nature.

Theoretically, a (world) war could devalue any currency, real estate can lose its value, new technologies can replace resources, and competition can ruin companies, but nothing can systematically undermine the long-term value of diamonds. While most diamond mines are nowadays known, with time diamonds will become even more rare, just as any natural resource will. This fact carries the key fundamental boosting effect on the long-term value of diamonds

Tangible

asset

Zero correlation to equities

Stable long-term returns

Offsetting weaker long-term returns

Diversification of portfolio

Lower volatility than asset classes

Favourable supply-demand situation

- June 15, 2022

- 0

- 1

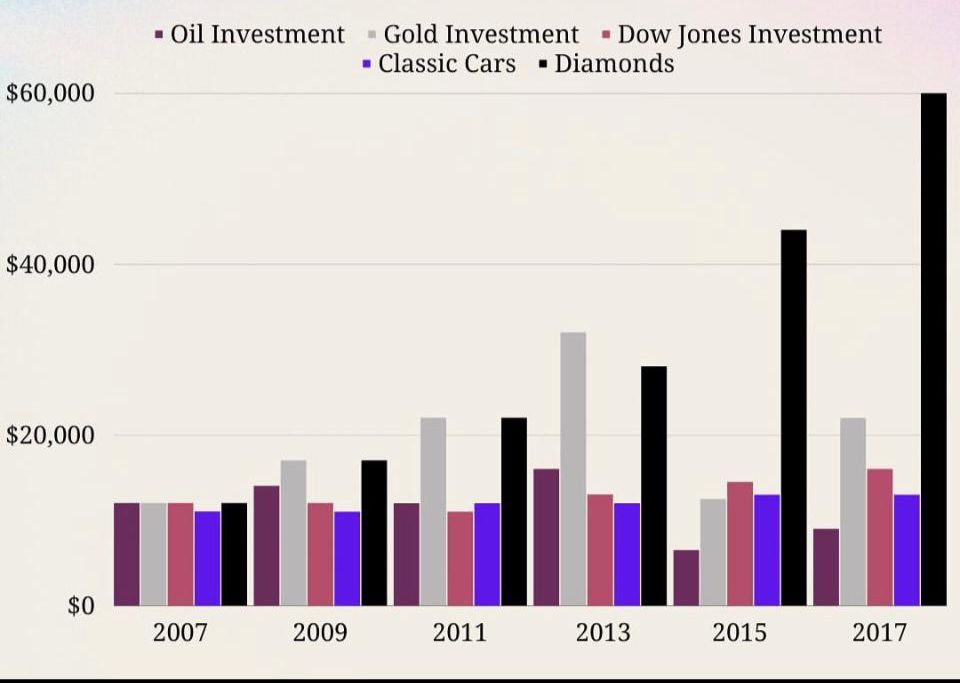

Traditional investments VS coloured diamonds

Unfortunately, the more conservative stocks and bonds don’t produce the results today that other asset classes potentially hold. Furthermore, some of the more popular alternative investment opportunities available are not tangible and subject to many constraints which make them less attractive. The upward trajectory of fancy colour diamond prices over the past few decades has been interrupted infrequently by very minor corrections. Even during the Great Financial Crisis of 2008, fancy colour diamonds outperformed almost every other asset class.

The graph represents Comparing the investment prices of a $10,000 investment with classic automobiles stock market, oil, gold, and coloured diamonds between 2007-2017.

Looking at the graph and understanding the time duration between 2007-2017, investment charts clearly show the enormous investment in diamonds over any other trade compared over the decade.

Although other assets have improved, and some significantly over the period of time, none can compare to the performance of coloured diamonds.

However, the best way for one to objectively quantify which investment opportunities have exhibited the highest returns in comparison to all other major assets in the market is to compare them. Here we describe which points to focus on in order to present the results of our comparisons.

In order to ascertain what the most common investment trends are, as well as acquire their historical price performance, one can simply browse through the most popular financial websites.

Natural fancy coloured diamonds are internationally recognized well established goods. They are extremely portable, and therefore easy to transport from one place to another. They have shown an impressive long-term price growth and serve a multi-function asset class as beautiful diamond jewellery and great investment pieces alike. They demonstrated excellent value retention and are an extremely private asset.

- June 15, 2022

- 0

- 1

The Enigma: Billion-year-old black diamond sold for £3.16m

A billion-year-old black diamond, believed to be the world’s largest cut diamond, has sold for £3.16m ($4.3m).

Named The Enigma, the 555.55 carat gem, which weighs about the same as a banana, had been expected to fetch more than £4.4m in the online action.

Auctioneer Sotheby’s said “the buyer has opted to use cryptocurrency for the purchase.”

There are competing theories about the origins of the stone, including that it was carried to Earth by an asteroid.

Sotheby’s did not identify the purchaser but after the auction cryptocurrency entrepreneur Richard Heart took to social media to claim that he was the buyer of The Enigma.

He told his more than 180,000 Twitter followers that “as soon as the payment’s gone through and possession’s been taken” the gem would be renamed the “HEX.com diamond”, in reference to the blockchain platform he founded.

The gem is a carbonado, which is one of the toughest forms of natural diamond.

Carbonados are extremely rare and have only ever been discovered in Brazil and the Central African Republic.

Because they contain osbornite, a mineral found only in meteors, they are believed to originate from space.

Sotheby’s described The Enigma as “one of the rarest, billion-year-old cosmic wonders known to humankind.”

Although the precise origin of black diamonds is shrouded in mystery.

Black diamonds are usually around 2.6 to 3.2 billion years old – a time before dinosaurs existed.

The Earth itself is around 4.65 billion years old, so not much older than black diamonds.

- Feb 10

- 0

- 1

World's largest blue diamond, 'exceptionally rare' at 15 carats, sells for $57 million

The world’s largest blue diamond now has a price tag to match its rarity.

The 15.10-carat diamond, called “The De Beers Cullinan Blue,” sold for $57.5 million Wednesday in an auction at Sotheby’s in Hong Kong.

The one-of-a-kind diamond had been expected to sell for about $48 million, but an anonymous buyer secured the gem via phone after an eight-minute bidding war among four potential buyers.

A press release from Sotheby’s noted that the diamond comes from South Africa’s Cullinan mine and was obtained in 2021. It has since attained all of the highest rankings on which colored diamonds are assessed. The Gemological Institute of America (GIA) categorized the jewel as “fancy vivid blue” – the top color grading of its class.

No jewelers nearby? Here’s how to measure your ring size at home.

“Blue diamonds of this importance are exceptionally rare, with only five examples over 10 carats ever having come to auction, none of which have exceeded 15 carats, making the appearance of this flawless gem a landmark event in itself,” a Sotheby’s statement said.

With a final price of $57,471,960, the gem barely missed eclipsing the record for the most expensive blue diamond ever to sell at auction. The 14.62-carat “Oppenheimer Blue” sold in 2016 for $57,541,779. That’s a difference of just under $70,000.

“It is truly a once-in-a-generation stone, and quite simply the greatest blue diamond of its size I have ever seen,” Patti Wong, chairman of Sotheby’s Asia, said in a statement.

- Feb 10

- 0

- 1